Polarisation of the market drives investors to seek alternatives

A defining characteristic of the commercial property market this year is the mismatch between buyers and sellers. There are plenty of willing sellers of retail assets but still few serious buyers, while owners of industrial assets are under siege from an endless queue of eager would-be purchasers. Some investors sense the possibility of a bargain in the office sector given uncertainty around the impact of home-working, but owners who have been successfully collecting rent during the pandemic have seen little need to provide one. Against this backdrop, some investors with cash to deploy are seeking a home in less mainstream parts of the market. Build-to-rent (BTR) continues to attract increasingly diverse capital, while several large deals have completed in the student sector, despite the challenges of the pandemic, and life sciences has emerged as a target for a wide range of investors.

There is, of course, nothing very alternative about residential, but it is nonetheless relatively new as an institutional asset class in this country. Although occupancy rates have dipped during the pandemic, this has done little to dampen the enthusiasm of those investors looking to build scale at pace. In the early years, the typical model was for purpose-built blocks in London and the largest regional cities, and the shortage of suitable stock meant that anyone looking to enter the sector would most likely have to build a portfolio from the ground up. More recently, the range of residential formats attracting interest has become far more diverse, and a highly competitive secondary market for good-quality stabilised assets has emerged. The forerunner of BTR, in many ways, was the student sector – and it was making a strong case for being considered mainstream prior to the pandemic. Investors have been understandably cautious while university life has been so heavily curtailed, but significant deals from the likes of GIC and Lone Star suggest investors are starting to look through the pandemic. As for life sciences, what was a very niche sub-sector has gained prominence as a direct consequence of the events of the past year.

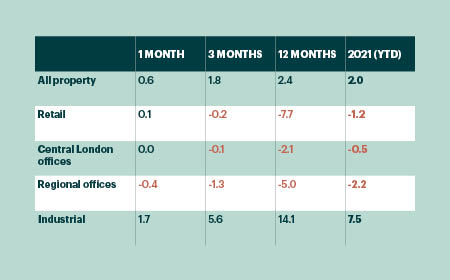

Commercial property returns

- Investment research firm MSCI reports that commercial property values rose by an average of 0.6% in May. Following a 6.3% decline in 2020, average values have now picked up by 2% so far this year. However, that apparent rebound has been entirely driven by rapid growth in industrial values.

- Capital values in the industrial sector are up by 7.5% already this year and are now 11% higher than they were at the onset of the pandemic. Growth in this period has been similar across logistics and standard industrial assets, and has been strongest in London (up by 18%).

- For the first time in more than three years, the retail sector saw a monthly increase in average capital values in May. This turnaround has been driven by early signs of recovery in the retail warehouse market, where values have edged up by 1.6% over the last three months. In contrast, shopping centre and shop values are down by 4.4% and 3.6% respectively, over that same period.

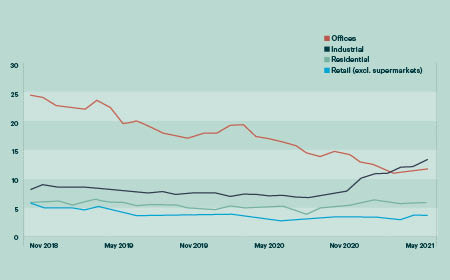

- At a sector level, offices are now the worst performer, with values off by 0.2% in May and by 1.6% in the year to date (YTD). An exception to that trend has been office parks in the South East, with 2% YTD growth driven almost entirely by science parks in and around Cambridge.