Office sector fragmenting in face of workplace revolution

There’s a wide range of opinions on the future of the office, with strident positions being taken by those who have the largest interest in one outcome or another. What scraps of anecdotal evidence are to be found are seized upon as proof by one camp or the other to bolster their position.

At one extreme, there are those who say that regular office attendance is over for ever, while at the other end of the spectrum some think that we will be back to our pre-Covid ways within a few short years. The reality is that it is too early to know how employers and employees across the breadth of the economy will react, and what shape the office market will eventually take. Nonetheless, despite all the uncertainty, there are a few known factors that will set the context for how the sector evolves.

There are three key factors supporting change. The first is technological. While videoconferencing has been widely available for many years, its adoption had been relatively slow before the pandemic. Now there can be few office-occupying businesses that haven’t used it to communicate with colleagues and/or customers. This widespread exposure lays the groundwork for businesses to make educated choices as to whether remote working suits them.

The second element is behavioural. Employers have seen that remote working can work and that productivity does not have to suffer.

The third is financial. Many businesses are enthusiastically eyeing the potential savings from working remotely and holding meetings virtually.

However, most employers and employees have also concluded that full-time remote working has many drawbacks, which have become increasingly apparent over time. These have been most pertinent in relation to onboarding new employees, developing existing staff, and driving new business. While it is easy enough to maintain the status quo, it is far more difficult to grow or evolve a business without meeting in person. Given these negative factors, most large employers seem to have alighted upon a ‘hybrid’ model. Yet there are very few details to date, and it is those details that will determine the impact on the office market.

Commercial property returns

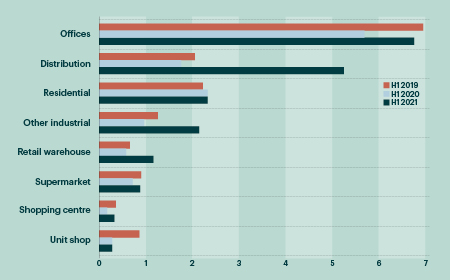

- Investment research firm MSCI reports that commercial property values rose by an average of 1.5% in June, while growth of 2.6% in Q2 represents the strongest quarter since Q4 2014. This continues to be driven almost entirely by the industrial sector, while many retail and office segments are still recording month-on-month declines.

- Industrial values are up by 6.6% over the second quarter and 10.9% in the first half of the year. On average, values in the sector are now 15% above their pre-Covid high. Capital value growth has been consistently strong across all regions for both multi-let and distribution.

- In contrast, the office sector is experiencing significant divergence. Office parks in the South East have seen value growth of 3% in Q2, seemingly driven entirely by science parks around Oxford and Cambridge. At the other end of the spectrum, average office values in Scotland, Wales and the Midlands are down 2.6% in the quarter.

- The retail sector is also seeing a broad spread of returns, as a nascent recovery in retail warehouse values deposes supermarkets as the top performing retail format for the first time since 2017. Quarterly growth of 2.5% and 2.0% respectively contrasts with declines of 2.6% and 2.7% for shops and shopping centres.