Key takeaways:

- Diversity & inclusion is being embraced at different speeds globally: there are large divergences between emerging and developed market countries as well as sectors.

- Companies with more female board representation were also more environmentally sustainable: especially when it comes to reducing emissions or switching to renewable energy sources.

- Women may be driving better environmental, social and governance (ESG) outcomes: though our analysis can’t conclusively say, external surveys show that women are on average stronger proponents of tackling climate change and emissions reduction through corporate strategy.

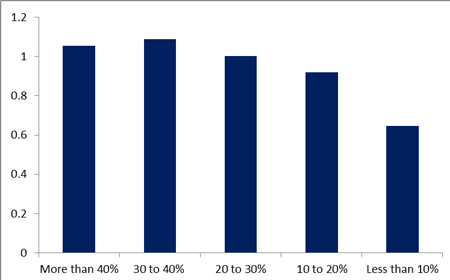

- Female board participation is also linked with better stock performance – at least in the US: this could be down to investors’ greater focus on corporate sustainability indicators.

Attention to environmental, social and governance (ESG) issues has grown in the run up to COP 26 later this year. We are particularly interested in understanding the relationship between ESG factors like carbon intensity or governance ratings and financial returns, both as a way of showing how ESG affects the bottom line and to help improve the tools we use to understand ESG risk.

But, does addressing one ESG risk make it likelier that businesses can effectively tackle others? That’s exactly what we explore in this article – specifically, whether more diversity & inclusion leads to better environmental sustainability. We started by examining the link between the proportion of those who identify as women on corporate boards and various measures of companies’ environmental performance. And in keeping with previous work, we also looked at whether there’s a correlation between female representation on boards and companies’ share price performance.

Corporate board composition is changing at uneven speeds across regions and sectors

We first need to consider what global corporate boards actually look like. To do so, we use the MSCI ACWI index, which consists of around 2,900 companies from across developed and emerging market countries.

We find that the average proportion of women on boards in recent years has been just 23%, globally, and that this proportion is only rising slowly – from 21% in 2014 to 24% in 2019. There’s a lot of variation, however, with the proportion at individual firms ranging from 0% to around 65%. Overall, European companies tend to have the highest proportion of female board members, while firms in emerging markets have much lower female representation on their boards on average.

And although corporate nationality is by far the biggest determinant, there are some significant differences between sectors, with financials, utilities and health care ranking much higher in terms of board diversity than technology and real estate companies.

Companies with more female board representation are more environmentally sustainable

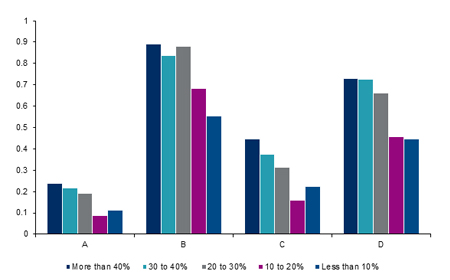

To explore whether there’s a link between female representation on corporate boards and environmental performance globally, we looked at four indicators of long-term sustainability:

A. Whether the company's three-year average energy consumption intensity is falling at a rate of at least 5% over the period, increasing at minimum at the same rate, or has been stable over the period.

B. Whether the company has programmes in place to reduce its carbon emissions.

C. Whether the company’s three-year average carbon emissions intensity has been falling at a rate of at least 5% over the period, increasing at minimum at the same rate, or has been stable over the period

D. Whether the company uses energy from renewable sources.

We then split the companies in our universe into five buckets based on the share of females on their board and plot their performance in each of these categories in the following chart.