Investment market activity

£2.2bn of investment deals transacted in February. This compares to £9.2bn in February 2020, but that figure was hugely distorted by Blackstone’s £4.7bn purchase of the IQ Student Accommodation. Even excluding that deal from the comparison, investment is currently only running at around 50% of the five-year average.

One year on from the IQ deal, £450m was committed to the student sector in two sizeable transactions. In the largest, Greystar paid £291m to KKR and Roundhill Capital for the Nido Student portfolio. The 2,163 rooms, across five assets in London, Glasgow, Coventry and Bristol, will be operated under a new European brand.

The race to build platforms of scale in the logistics sector shows no sign of slowing. After coming up short on a number of large portfolios in 2020, BentallGreenOak acquired 2.1 million square feet across seven warehouses for £303m, an initial yield of 5.5%. The vendor, Morgan Stanley, bought the portfolio from Segro in late 2019 for £240m.

Supermarket REIT expanded its portfolio further by acquiring, alongside the BA Pension Fund, a 25.5% stake in a portfolio of freehold reversions from Aviva for £115m. The JV partners now control 51% of the portfolio, from which the rental income has been securitised. In 2023, Sainsbury’s has the option to extend for 20 years or vacate.

Science parks are a growing niche, with two significant deals completing in February. Brockton Everlast beat off strong competition to acquire five buildings on Cambridge Science Park from L&G. The £99m deal follows its recent £45m purchase of two other buildings on the park. Meanwhile, Bruntwood SciTech continued to build its portfolio with the purchase of Melbourn Science Park in Cambridge for £42m.

Market yields

Knight Frank’s benchmark yields illustrate that Central London has not escaped the negative sentiment that has engulfed the retail sector, and the notional impact on values from outward yield shift is very significant. Yields moving from 2.75% to 3.5% on Oxford Street imply a notional value loss of around 20% before any impact from reduced rental values.

Prime retail yields in the major regional cities have also moved out a further 25bp in the last month, and are now up to 100bp softer than they were a year ago. Having appeared relatively stable towards the end of 2020, sentiment has perhaps been soured by speculation of a material reduction in the regularity with which workers will commute to the office.

The situation is even more stark for shopping centres, with Knight Frank estimating that yields for the strongest regional shopping centres moved out by 100bp in the last month alone and are out by 200bp year on year. Yields for sub-regional and local centres also softened further. In contrast, yields for retail warehouses with long income firmed up by 25bp, the first hardening of benchmarks in the sector for several years.

Red-hot investor demand for logistics assets continues to force down yields, with the benchmark for secondary assets (with 10-year income) firming up by 25bp in the month. Having shifted out by 50bp in the immediate onset of the pandemic, they are now 50bp keener still than their pre-pandemic low.

Auctions

Allsop’s March commercial auction raised £57m from 86 lots, almost double the proceeds of its first online-only auction a year ago. Two portfolios, of units let to Boots and Santander, achieved 43 sales between them, raising a total of £23.4m.

The highest price achieved across the book was for the sale of the Loreburn shopping centre in Dumfries, which sold towards the top of the guide price range of £2.75m - £3.0m. The centre has 45 tenants, with the current rent reflecting a notional gross initial yield of roughly 30%.

Market forecasts

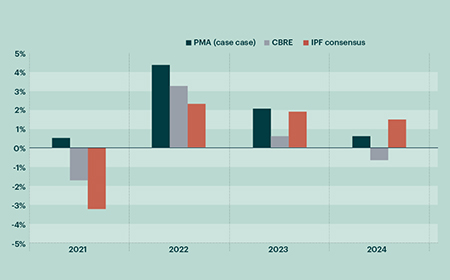

Independent forecaster PMA has released its spring forecast update. Under their main scenario, which assumes that the road map out of lockdown is achieved, PMA anticipates that robust economic growth will return GDP to pre-pandemic levels by the end of next year.

Under this main scenario, most parts of the office and industrial sectors would record some degree of capital growth this year and robust growth in 2022. In contrast, PMA expects the retail sector to see no recovery at a market level despite the favourable economic backdrop.

PMA anticipates further material valuation declines this year for shops (-13%) and shopping centres (-17%). Some comfort can perhaps be taken that this forecast implies a trend from here that would be a significant moderation of the rate of decline seen over the past 12 months.

PMA does not anticipate a dramatic impact on office values from the predicted increase in remote working. Indeed, they expect capital values to rise in Central London and the major regional cities this year. Growth is expected to be slower for business parks and smaller regional markets.