The global economy seems to be on track for a swift recovery. Purchasing Managers’ Index (PMI) prints across key geographies improved over the month, notwithstanding the effect of ongoing restrictions. What’s more, firms are increasingly upbeat on the outlook and even indicated reduced firing intentions.

Resilient

After a brutal decline in January, the composite UK PMI recovered swiftly in February, printing at 49.8 versus 41.2 last month. Though still a little shy of the watermark 50 level, the improvement is notable, bearing testimony to impressive adaptation demonstrated by business during the time of a third lockdown. At the sector level, the gain was led by the services sector which seems to have nearly stabilised, though inter-sectoral variations remain. But the manufacturing sector turned out to be the Achilles heel. More than half of all companies reporting lower exports attributed the decline to Brexit-related factors.

Online boost from lockdown 3.0

Talking about adaption, nowhere is this starker than the shift to online retail. January’s closure of non-essential stores across the UK pushed online purchases up to a new record share of spend at 35%. That’s higher than we saw in previous waves and colossal compared to the 19.5% recorded a year ago. But it wasn’t enough to totally offset the new restrictions. Overall spending still fell by 8% compared to December, leaving it 5.5% below pre-Covid levels. Trends in transaction data point towards higher spending in February so hopefully we’ll see that gap close rapidly from here.

Lingering

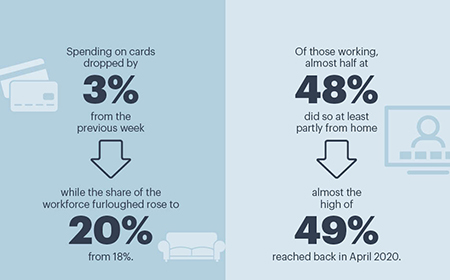

Two steps forward, one back this week. After encouraging spring-like signs the previous week, spending on cards dropped by 3%, while the share of the workforce furloughed rose to one in five (20%, from 18%). Nearly half of those working (48%) did so at least partly from home, almost the high of 49% reached back in April 2020. The squeeze on freedom, activity and, ultimately, the virus, are all taking longer than some hoped. Yet roughly one in five of us have antibodies. So we’re getting there, thankfully, because unsurprisingly our collective well-being remains almost subterranean.